Bitcoin vs Monero: Money, Store of Value and Anonymity

In the early days of cryptocurrency, Bitcoin was the clear leader in the industry. However, as time has gone on, other alternatives have emerged that offer different features than what Bitcoin provides.

Other than Ethereum, there’s only one other that compares in BTC’s potential. The only other alternative in question is Monero XMR.

In this intel, we’ll compare Bitcoin and Monero to see which one is better when it comes to being used as money, store of value and for anonymity / privacy protection.

Medium of Exchange

When it comes to using a cryptocurrency as money, Bitcoin is generally accepted more widely than Monero. While both cryptocurrencies offer fast transaction speeds – about 10 minutes for Bitcoin (seconds if using Lightning) and about 2 minutes for Monero. Bitcoin’s massively larger user base means that merchants are more likely to accept it over Monero. However, the fees associated with using Monero are significantly lower than those associated with using Bitcoin – but again, if using Lightning, fees would be next to nothing.

Interestingly but not surprisingly, the almost universally favored currency used on the darknet is now Monero, completely taking over Bitcoin’s dominance. This is due to the fact that Monero’s untraceable features makes it ideal for the darknet. This is a powerful sign that Monero’s primary use case will eventually be needed everywhere else outside of the darknet.

When that time comes, Monero could again eat away at Bitcoin’s dominance as a medium of exchange.

Store of Value

In terms of being a store of value, both cryptocurrencies have their advantages and disadvantages. On the one hand, Bitcoin is seen by many as a secure long-term investment due to its limited supply and relative stability in comparison to other cryptocurrencies. On the other hand, due to its limited supply and high market capitalization some investors feel that it may be too late to invest in Bitcoin at this point.

Monero offers an alternative option for investors who want exposure to the cryptocurrency market without having to worry about investing in something that can become too saturated or expensive too quickly. Additionally, while there is no guarantee that any cryptocurrency will increase in value over time, some analysts believe that due to its decentralized nature and focus on privacy protection, Monero may be better-positioned for long-term success than other cryptocurrencies.

While Monero doesn’t have a fixed supply like Bitcoin, it was brilliantly coded with tail emissions which makes it one of the least minted (supply) coins giving it currently 1 percent inflation of which will increase to 0 slowly over time. Whereas Bitcoin’s inflation rate is currently and will be around 1.79 percent for the foreseeable future.

Some say Bitcoin is “Gold 2.0” as it shares many of gold’s valuable factors, particularly scarcity. Although more gold can always be mined, more Bitcoin after reaching 21,000,000 BTC units, more will never be “mined” again. This gives it an attractive element of a store of wealth.

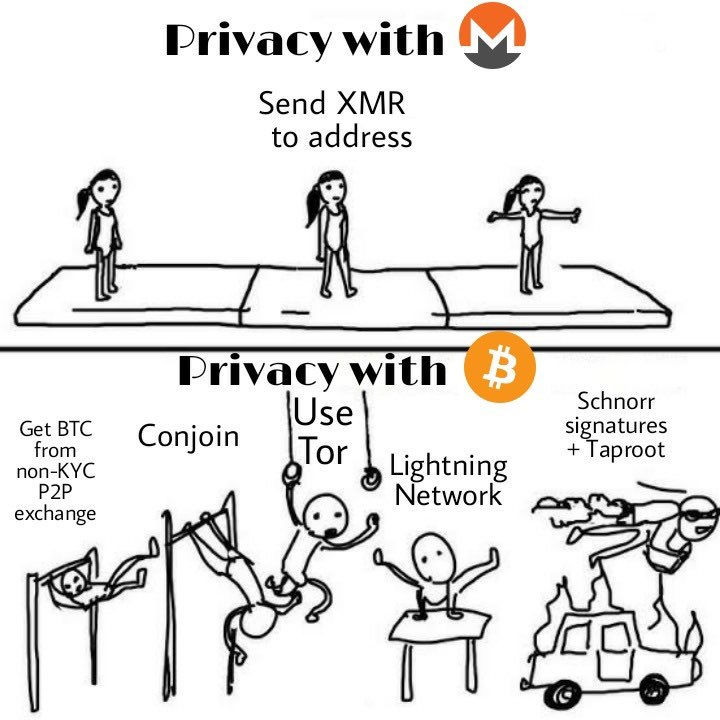

Privacy and Anonymity

Finally, when it comes to privacy and anonymity protection both currencies have their strengths; however, one could argue that Monero offers significantly better privacy features than Bitcoin does. Specifically, all transactions conducted using Monero are private by default whereas transactions conducted using Bitcoin can be publicly viewed on the blockchain if desired (although users can also opt for near private transactions through services like CoinJoin).

Additionally, while both currencies offer stealth addresses – randomly generated addresses intended to protect user identities – only Monero offers RingCT technology which further enhances user anonymity by preventing third parties from linking transactions together even if they know what address was used for each transaction.

Bitcoin is pseudonymous and potentially private whereas Monero is anonymous and always private. Monero is the “numbered Swiss bank account” of the future.

Overall it’s difficult to say definitively which currency is better when compared side-by-side because each has its own unique benefits and drawbacks depending on how you intend on using them. However based on our analysis it appears that when it comes to being used as money or a store of value then Bitcoin may be a better option right now. But if your main concern is privacy then you may find greater peace of mind utilizing Monero instead.

Ultimately though it’s up the individual or organization in question and their specific needs should determine which cryptocurrency best suits their needs; however with continued development from both sides this battle could certainly change over time so staying informed on all fronts will enable users make an informed decision before investing any money into either option.

[OPTICS : Bitcoin VERSUS Monero]